Commentary: America chugs along in a 'K-shaped' economy

Published in Op Eds

People are talking about America’s “K-shaped economy,” so named because charts show different sectors’ fortunes diverging like the two arms of that letter. Recently, for example, data services firm ADP reported 32,000 lost U.S. jobs in November — a sharp reversal from October’s 47,000 gain, but not unexpected. But within that data, smaller firms employing from 1 to 49 workers laid off 120,000 while larger employers added workers.

No, this is not the time to say the economy is “healthy” or “unhealthy.” There are always strong and weak points, but right now, this is especially true.

Times are good for parts of the U.S. economy. Really good, in fact. That’s the upward part of the K.

These healthier areas may be counted on one hand, but they’re big ones: health care, education, information, and commercial investment (which should be read as “data center construction,” a key topic to be discussed later). A huge number of people are experiencing Gatsby-like portfolio gains from a bull market.

In fact, 2024 data analyzed by the Swiss bank UBS show that the U.S. has almost 24 million millionaires, with 1,000 joining those ranks every day. Yes, the K-economy’s upper leg has a lot of power supporting it, and that helps explain strong retail sales.

Oh, but there is always something offsetting, isn’t there? Our economy’s lower leg is sinking.

For example, even with record-level tariffs in place to give room for more hiring, there is no growth overall in manufacturing employment or production and very little in construction. We do see job gains in auto batteries, engineered wood products, and parts of the auto industry. Still, Americans who work in industries like these are concerned about keeping jobs, lost purchasing power, and affordability at the supermarket. They are pessimistic about prosperity’s prospects.

Age and experience play a role, too. New college grads are struggling to find jobs as AI and automation change the labor market. There are 42 million young adults wrestling with $1.8 trillion in student debt that under Trump administration rules must be paid or offset by work and service.

All of this and more helps explain the limping lower leg, and it didn’t just begin. ADP (currently the most dependable labor market data source with the Bureau of Labor Statistics still catching up from the government shutdown) has reported falling employment growth numbers since July.

Surprisingly, when the two legs are averaged together, chances are good that the government will report better than 4.0% growth in real GDP for the third quarter. That’s a strong result, but how can it be?

How can a K-shaped economy perform so well when hiring is practically dead in the water, industrial production gains are practically zero and health and educational services are two of America’s hottest sectors? We can hardly achieve lasting growth and prosperity on the backs of taxpayer-subsidized services.

The good news is that we may not have to try. That’s because of the K-economy’s big GDP producer: massive data center growth and investment in power plants to keep the centers running.

Indeed, the impact is so large that it has pushed consumption spending out of first place in explaining GDP growth. A recent study by Harvard economist Jason Furman found that excluding spending on technology-related infrastructure, real GDP growth in 2025’s first half would have been just 0.1% instead of the 2.2% ultimately reported by the Commerce Department. For the third quarter, the Atlanta Fed’s “GDPNow” estimate, which is revised almost daily, is calling for 3.9% real growth.

We have a mixed economy, for sure. Hopefully, our healthiest sector can carry much of the load until a new information revolution pays off in more ways and other sectors can find their footing again. But with such uncertainty, it’s not a good time to say “prosperity is just around the corner” for everyone.

____

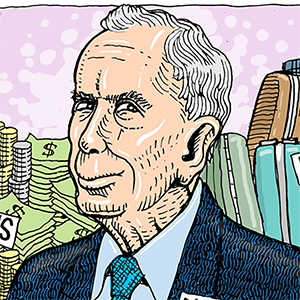

Bruce Yandle is a distinguished senior fellow with the Mercatus Center at George Mason University, dean emeritus of the Clemson College of Business and Behavioral Sciences, a former executive director of the Federal Trade Commission, and a former senior economist on the President’s Council on Wage and Price Stability.

___

©2025 Tribune Content Agency, LLC.

Comments