Chicago economist Anna Paulson will take over Philly Fed as Trump pressures central bank to cut the price of money

Published in Business News

Anna Paulson, a career economist at the Federal Reserve's Chicago bank, will take over as president of the Federal Reserve Bank of Philadelphia, the bank said Thursday morning.

An insurance scholar, Paulson, 60, cowrote a 2017 paper on the declining number of Americans from all levels of society who buy life insurance. She has also studied how households respond to economic crisis.

Her backers for the job portrayed her as a moderate among the cheap-money "doves" and anti-inflation "hawks" who wrestle over Fed interest-rate policy.

"For two decades, Anna has demonstrated a strong commitment to the Federal Reserve's dual mandate of price stability and maximum employment," Anthony Ibargüen, a King of Prussia water executive who headed the search committee, said in a brief statement.

What does the Fed do?

The Fed is a federal government agency that serves as the U.S. central bank. Charged by Congress with setting steady price and employment growth levels, Fed leaders set interest rate targets, oversee hundreds of economists who generate research to guide its policies, and serve as one of several federal bank regulators, sometimes acting as "lender of last resort" to keep financial markets working during economic crises.

The Fed's national leaders, including chairman Jerome Powell, are appointed by the president and confirmed by the Senate. The 12 local Fed presidents, who rotate on and off a minority of seats on the national Fed's board of governors, report to local boards dominated by area business leaders, plus labor union or nonprofit representatives.

The Philadelphia Fed president heads a staff of regulators, one of several federal and state agencies that oversee banks in the Third Federal District, which includes eastern Pennsylvania, South Jersey and Delaware.

Who is Anna Paulson?

Paulson would serve on the board of governors next year. She has attended its Washington, D.C., meetings as a senior Chicago Fed manager.

She holds a bachelor's degree from Carleton College and a doctorate in economics from the University of Chicago. She was a postdoctoral fellow at Princeton University.

Paulson will move to the Philadelphia area, where she said she'll lead a team of economists and other staff "deeply committed to fostering the stability, integrity, and efficiency of the nation's monetary, financial and payment systems." She'll take over from Patrick Harker after his 10-year term ends June 30.

She was chosen by a search team including Temple University President John Fry, Comcast lobbyist Bret Perkins, Culligan Quench executive Tony Ibargüen, Sharmain Matlock-Turner of the Urban Affairs Coalition, Children's Hospital of Philadelphia executive Kisha Hortman Hawthorne, and Crystal Steel Fabricators founder William Lo.

Paulson joined the Chicago Fed in 2001 from Northwestern University's business school, where she was assistant professor and served as its head of research, topping its team of economists since 2019.

Her appointment includes a rotating term on the national Federal Reserve's Open Market Committee, which sets interest rate targets. Investors are scrutinizing Paulson's record to see whether she is more likely to support high interest rates in a bid to thwart price inflation or prefer cheap money so businesses and consumers can borrow more easily, fueling short-term economic growth.

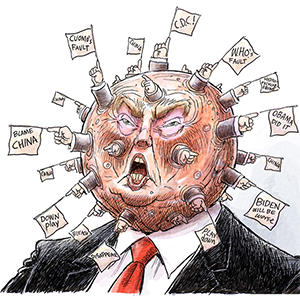

The Trump effect

The switch comes at a time when Federal Reserve President Jerome Powell, who was appointed by President Donald Trump in his first term, has lately come under fire from Trump. On Tuesday, Powell said Trump's unprecedented wave of tariffs on imported materials and consumer goods are "highly likely" to inflate U.S. prices, at least in the near term.

Powell's "termination cannot come fast enough," shot back Trump in a social-media posting. Powell's term ends in 2026, and he has said he has no intention of stepping down early.

Philadelphia's banking history

Harker, whom Paulson replaces, is an engineer, economist, former Wharton School dean and University of Delaware president who has presided over one of the smallest of the 12 Federal Reserve districts since 2015.

Philadelphia was an early hub of U.S. finance; its banks helped fund industrial development when the city, with its thousands of specialized factories, was dubbed the "Workshop of the World" in the late 1800s and early 1900s.

All of the city's billion-dollar banks were sold to out-of-town lenders in a wave of consolidation in the 1980s and 1990s. Philadelphia and most of its suburbs now rely more on professional and service jobs at national companies — though factories still employ one of five workers in Lancaster and Berks Counties, where midsize community banks survive.

With few banks left to regulate compared to other Fed zones, Harker was a scholar of and advocate for workforce development, steering young people toward manufacturing and building-trades careers and emerging occupations, as automation threatened traditional jobs.

On his watch, the Fed, once a major check and payments processor, also expanded research into electronic payments systems and emerging forms of money. Delaware is a center of the payments industry, home to credit card and other specialized operations for JPMorgan Chase, Bank of America, and other national lenders that come under Fed scrutiny.

©2025 The Philadelphia Inquirer, LLC. Visit at inquirer.com. Distributed by Tribune Content Agency, LLC.

Comments