Trump's tangled tariffs sow confusion as negotiators line up

Published in Political News

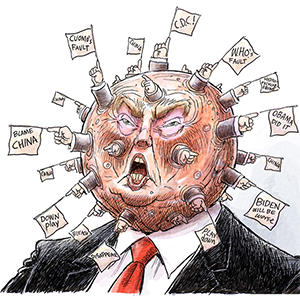

President Donald Trump’s tariff exclusions for smartphones and other tech products have added to a growing set of confusing signals for companies and trading partners digesting how to engage a White House still promising to negotiate dozens of new deals in America’s favor.

The dizzying weekend saw Trump exclude popular consumer electronics from 125% tariffs on China and a 10% baseline global tariff. The move exempted more than $101 billion in U.S. imports from China alone and was seen as a short-term win for U.S. tech champions like Apple Inc. and Nvidia Corp.

Trump and top aides on Sunday, though, declared that the reprieve was only a procedural maneuver to ultimately hit those tech products with a different, sector-specific tariff.

For financial markets handicapping the economic spillovers, that again made finding clarity hard in a strategy the White House insists is carefully constructed but critics see as subject to the whims of a transactional president.

For countries sending delegations to Washington to negotiate — like the European Union’s trade chief is aiming to do Monday — fresh questions arose about whether talking is even the best approach.

And for international companies operating in an environment where rules can change overnight, inactivity during the turmoil is emerging as the safest bet.

‘Act first’

“The Trump team continues to follow an approach of act first, then make adjustments as needed,” said Wendy Cutler, a former senior U.S. trade negotiator who is now at the Asia Society Policy Institute. “This approach contributes to more unpredictability for investors and our trading partners, who may no longer conclude that rushing to negotiate with the U.S. is the best approach.”

Trump is hailing a flurry of negotiations aimed at locking in reduced country-by-country tariffs, which he has long said he won’t apply to sectors that have their own levies.

Such duties have already been rolled out for autos, steel, and aluminum. More national security investigations that would lead to tariffs are expected in the weeks ahead on pharmaceuticals, semiconductors and other vital sectors.

“We are taking a look at Semiconductors and the WHOLE ELECTRONICS SUPPLY CHAIN in the upcoming National Security Tariff Investigations,” Trump said in a social media post Sunday. “What has been exposed is that we need to make products in the United States, and that we will not be held hostage by other Countries, especially hostile trading Nations like China.”

China’s government said the U.S. decision to exempt certain consumer electronics was a small step and called for abolishing tariffs altogether. President Xi Jinping is heading to Vietnam, Malaysia and Cambodia this week to shore up relationships in the region.

In Washington, the frenetic weekend shifts further muddy the water — even if Trump’s administration had long flagged some of them. While Trump has indicated he will haggle over country rates, questions are now emerging over whether the sectoral tariffs are up for bargaining as well.

“Those are not available for negotiation,” Commerce Secretary Howard Lutnick told ABC’s “This Week.”

Hours later, however, Trump signaled an openness to talks with companies over the scope of his semiconductor tariffs. “We’ll be discussing it, but we’ll also talk to companies,” he told reporters on the plane flying back from Florida. “You have to show a certain flexibility.”

Fueling inactivity

The White House’s messaging is creating more uncertainty for companies dependent on imports to the U.S.

“The whole system seems designed to create paralysis,” Ryan Petersen, the founder and CEO of digital freight platform Flexport Inc., wrote in a social media post Sunday.

Tobias Meyer, chief executive officer of cargo and logistics giant DHL Group, said companies trying to conform with constantly shifting U.S. directives “don’t know even if something’s announced, whether two days later it’s not changed again.”

“You really see some fatigue of decision makers in manufacturing and also in the distribution sector,” Meyer said Monday in a Bloomberg Television interview. “I hear a lot that customers simply say, ‘we’ll wait for now.’”

The economic fallout of such a freezing up of trade could be wide. On Monday, Singapore’s trade ministry downgraded its forecast for economic growth this year, saying businesses and consumers may “adopt a ‘wait-and-see’ approach before making spending decisions.”

Diplomats and other officials who’ve sought to engage in talks with the U.S. are similarly unsure about how best to proceed.

Bond market signals

In the wake of Trump’s April 2 unveiling of his new tariffs, senior administration officials publicly insisted there wouldn’t be any negotiations over his border levies. Trump’s goal of repatriating manufacturing was an inviolable priority, they said, and the purpose of the duties imposed in the name of reducing a trade deficit that Trump has declared a national emergency.

The weekend pullback on tech tariffs was the second major adjustment to Trump’s duty regime in a matter of days.

On April 9, the same day new duties unveiled the week before went into effect on dozens of countries, Trump abruptly reduced them all to 10% for 90 days — except for China — amid rapidly increasing concerns about a bond market selloff. There are also growing signs that the tariffs and the growing odds of a recession that have come with them are politically unpopular.

A CBS poll published Sunday found that a plurality of Americans expect Trump’s tariffs, which have raised the U.S.’s average applied duties to their highest level in more than a century, to hurt their financial situation.

The administration is now focusing on negotiations with countries including Vietnam, South Korea and Japan. The stated aim is to use the leverage Trump has built up with his tariffs to extract concessions that would open the door for more U.S. exports or new investments in the U.S. While Trump has dropped tariff rates for those countries to 10% for 90 days to tee up talks, he hasn’t ruled out raising them again.

How successful talks will be remains unclear, as is what exactly Trump wants or how firm he will be in holding to a 10% baseline that he and aides had set as a floor.

Flying to Florida on Friday evening, Trump called the 10% “pretty close” to a floor, but he didn’t rule out going lower. That has opened the door for countries to push for lower tariffs in their own negotiations, including with EU trade chief Maros Sefcovic who will meet his counterparts in Washington today.

European officials hope his trip will provide a better sense of the U.S.’s willingness to negotiate and what its priorities are. But in spite of repeated calls for European unity, there’s no consensus on how far the bloc should go with concessions, or how to retaliate if talks fail.

Trump’s weekend exclusion did not apply to the baseline 20% tariff he applied to China over fentanyl, and that levy remains in effect. China also has signaled so far that it is not interested in any negotiations.

Trump’s unpredictability still hangs over any talks as does his commitment to the idea of tariffs as an economic tool. Diplomats involved in discussions with Lutnick and U.S. Trade Representative Jamieson Greer ahead of April 2 said even those Cabinet members stressed privately that any agreement would still have to be approved by Trump and that they couldn’t guarantee his response.

Chip strategy

The expected so-called Section 232 national security investigations that would lead to sectoral tariffs could take months. Friday’s exemption list provides the clearest sign yet of which products could be affected.

One key area is AI hardware, which the U.S. imports primarily from Taiwan as well as Mexico, where a host of Taiwanese companies handle final assembly of products destined for the U.S.

AI servers shipped from Mexico have so far escaped the tariffs, as much of that hardware falls under the U.S.-Mexico-Canada Agreement tariff exemption, according to Bernstein Research analyst Stacy Rasgon.

If the eventual chip-sector tariffs do end up hitting servers, one guide for what’s to come may lie in Trump’s previous sectoral tariffs for autos and auto parts. Those products, subject to a 25% rate, are eligible for the USMCA exemption until the administration devises a process to impose tariffs on non U.S.-content.

But for AI servers and all other products on the exemption list that contain chips — including consumer tech like phones and computers — there’s still a huge open question of whether the eventual duties would apply to the entire finished goods, or just the foreign-made chips they contain.

Trump’s ultimate aim is to push more of the tech industry to rely on American supply chains. That would require a massive expansion of U.S. chipmaking — something that’s already underway, thanks in large part to the 2022 Chips and Science Act.

Trump, however, wants to scrap the bipartisan law, and his latest tariff moves could make it more expensive for companies to complete the factories they’ve announced. Based on Friday’s exemption list, the chip-sector tariffs could also hit manufacturing tools, which form the lion’s share of the price tag for new chip plants.

----------

With assistance from Swati Pandey and Haslinda Amin.

©2025 Bloomberg L.P. Visit bloomberg.com. Distributed by Tribune Content Agency, LLC.

Comments