Editorial: Attacking irresponsible student loan policies

Published in Op Eds

Changes are coming to the federal student loan program. And it can’t happen fast enough.

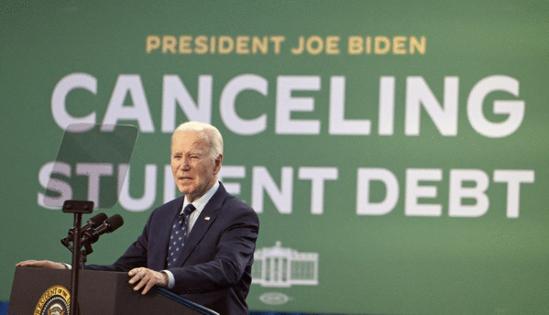

President Donald Trump’s “one, big beautiful bill,” enacted and signed last summer, includes a number of provisions intended to protect taxpayers from student loan defaults. This is in stark contrast to President Joe Biden’s approach, which was to forgive billions in outstanding obligations as a means of buying political support. The Supreme Court ultimately ruled that Biden lacked the authority to unilaterally take such a step.

The federal student loan program lacks even rudimentary safeguards common in the private sector. Showering cash on teenagers and young adults with little credit history is a recipe for fiscal disaster and has also provided cover for the massive increases in tuition that plague so many four-year institutions of higher learning. Doling out billions to borrowers leaving school with degrees in low-paying majors can in no way be described as fiscally responsible — for the lender or the borrower.

It should thus be no surprise that student loan recipients currently owe $1.8 trillion, with as much as 10% of that in default.

Yet while the problems with the current system are obvious, it hums along on autopilot. What’s that old saying about the definition of insanity? Provisions in the new law that go into effect this year aim to change that.

For one, a Biden-era repayment plan with extremely generous payment terms — which only encourages more high-risk borrowing — will go by the wayside, with borrowers moved into other existing plans. Secondly, the legislation includes caps for graduate school assistance, which had previously been unlimited. Beginning in July, grad school students may borrow a maximum of $100,000 — $200,000 if they are pursuing a professional degree such as law or medicine. There will also be a lifetime limit for graduate students of $257,000, including undergraduate loans.

The bill includes incentives for schools to lower the cost of a degree and to ensure that graduates meet certain average income thresholds, a nudge to help students attain degrees in fields that offer enhanced opportunities.

“The law is clear: If you take out a loan, you must pay it back,” Education Department official Nicholas Kent said in a statement. “American taxpayers can now rest assured they will no longer be forced to serve as collateral for illegal and irresponsible student loan policies.”

The student loan program is a well-intentioned effort to help more students get through college. But the results speak for themselves as millions of students drown themselves in debt. The current system is fiscally unsustainable and cries out for taxpayer protections. The White House deserves credit for moving in the right direction.

©2026 Las Vegas Review-Journal. Visit reviewjournal.com.. Distributed by Tribune Content Agency, LLC.

Comments