Commentary: The affordability crisis is real and tariffs caused it

Published in Op Eds

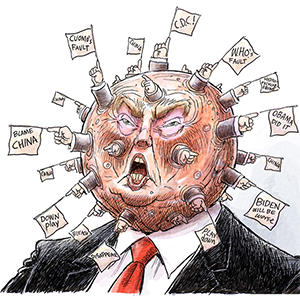

President Donald Trump traveled to Pennsylvania last week to double down on his economic messages: The affordability concerns of Americans are a Democratic “hoax” and if anyone is unhappy, it's a Blame Biden Economy.

A more fitting description would be the Trump Self-Inflicted Wound Economy.

It's not unusual for presidents starting their terms to attribute economic troubles to their predecessors. Fair enough. But Trump’s approach of placing the blame on Biden is not just a little spin on the ball: It's an effort to completely mislead Americans on the economy his administration inherited, and the harm his policies have done.

Look at the facts. It is true that global inflation in the post-COVID period — especially in 2022 — drove the costs of many basic goods like groceries to be significantly higher than the pre-pandemic prices Americans remembered. In the Biden White House, we learned painfully that even strong job growth, low unemployment and moderating inflation couldn’t overcome voter frustration over the level of key prices.

But did the Trump administration inherit a weak economy with out-of-control inflation that he is now digging our nation out of? Not even close.

When Trump took office, unemployment hovered around 4%, following the longest period of sub-4% unemployment in 55 years. Under Trump, with the November jobs report out yesterday, the unemployment rate is now at 4.6% — the highest in over four years, with black unemployment having now risen by over a third, from 6.2% to 8.3%.

After historic job growth under Biden in the first years of his term, job growth in 2024 was still solid — averaging about 100,000 new jobs per month — even incorporating expected downward revisions.

Today, under Trump, if we exclude the health care and social assistance sector, the economy has lost 182,000 jobs over seven months since the Liberation Day tariffs were announced in April. Worse still, in a recent press conference, Federal Reserve Chairman Jerome Powell estimated that, with revisions, the economy has lost 20,000 jobs a month since then.

How about consumer sentiment? It’s fallen by 26% since Biden left office. The subindex on current economic conditions has not only fallen by 32% since Biden left office; it has reached new record lows in each of the last two months for the 48 years these numbers have been tracked. Yes: worse than every month of the pandemic and the Great Recession of 2008-09. When Trump was elected, typical Americans were projecting inflation of 2.6% in the coming year. Now, inflation expectations are at 4.1%.

Indeed, following the election, inflation had significantly moderated and top independent experts were projecting it would continue to fall by the end of 2025 to very close to the Federal Reserve’s target of 2%, as measured by the core personal consumption expenditures (PCE) price index. In the second half of 2024, core PCE inflation was only 2.5%. At the time Trump was about to enter the White House, Goldman Sachs was projecting core PCE to fall to 2.1% by year-end while the IMF projected inflation would fall “close to” 2%.

The reality is that Trump was inheriting an economy that was on a path toward what he might have called a big, beautiful soft landing.

Yet Trump’s erratic, extensive and often across-the-board tariff increases reversed that momentum. Core PCE inflation has re-accelerated to 2.8% since April. And consumer price index inflation, the other commonly watched measure, came down significantly in the first few months before Trump’s Liberation Day policies, but has seen its overall and core measures surge at 3.6% annualized clips over the last three months — defying projections by Trump officials that things would improve the longer he’s in office.

A top scholarly report documents that without Trump’s policies, CPI would have been 2.2% in August, as opposed to the 2.9% it came in at.

Other Trump policies also threaten to upend the downward inflation path he inherited. Electricity prices are up 4.3% in just eight months, as Trump guts clean energy investments while imposing tariffs on electrical inputs needed to expand grid capacity in the face of surging demand from AI data centers.

Both Bank of America and Moody’s fear that Trump’s immigration crackdown will stoke further inflation in sectors where immigrant workers are concentrated.

And the administration and Republican-led Congress are marching ahead on more than doubling the average health care premium for more than 22 million Americans by allowing the enhanced premium tax credits introduced in 2021 to lapse. Trump’s approach will raise health care costs further, create sicker risk pools, and result in expanded uncompensated care through huge cuts in Medicaid.

While Trump’s second term has been fortunate to coincide with a dramatic surge in private-sector AI investment, economic weakness has been clearly attributable to Trump’s policies. The White House economic team essentially acknowledged this, at least in part, by claiming to improve affordability by reversing its own tariffs on goods like coffee and bananas, which can hardly even be grown in the U.S.

Last week, Powell attributed the rise in inflation to Trump’s tariffs, and many economists believe some of the weakening in the job market is due to companies dealing with the higher costs since Liberation Day.

With many companies expressing the need to raise prices further in 2026, the best hope for further progress on affordability may be the Supreme Court reversing more of Trump’s policies by finding his use of the International Emergency Economic Powers Act to be unlawful. Court reversals are not cures, but they at least offer a bandage for the Self-Inflicted Wound Economy.

____

This column reflects the personal views of the author and does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

Gene Sperling was director of the National Economic Council under Presidents Bill Clinton and Barack Obama and was a senior adviser to President Joe Biden.

_____

©2025 Bloomberg L.P. Visit bloomberg.com/opinion. Distributed by Tribune Content Agency, LLC.

Comments