COUNTERPOINT: Unhappy with tips jobs? Get another job

Published in Op Eds

The other night, after the House passed the “Big Beautiful Bill of Goods” (BBBOG), I went out to dinner at one of my favorite restaurants in Philadelphia. I know the people there; they are friendly, hardworking, and they allow me to speak Italian with them. It is a place where I can forget that I am in a city where some of the trash is piling up on street corners (the garbage collectors are on strike), and some people are marching through those streets yelling about genocide. This restaurant is my Italian home away from home.

After enjoying my Carciofi fritti and tagliatelle alla panna, all washed down with an Aperol Spritz, I was faced with an existential crisis. Pondering the check, which was quite reasonable, I had to decide whether to leave the 40 percent that I always tip at this restaurant I love, or cling to my principles and do what I said I would do on Facebook: leave nothing more than a 10% token.

I made this vow of gratuity poverty after reading about the “no tax on tips” provision in the BBBOG. This, among many other aspects of the egregious mess that Congress passed, was one of the things that angered me the most. Why give special treatment to money you earn from tips, as opposed to all the other ways hard-working Americans pay the bills?

Enough about food industry workers making their living on tips because they earn so little in their regular paychecks. Enough about how they work so hard to make sure that we all enjoy magnificent dining experiences (yeah, right.)

I’ve heard these arguments repeatedly. My response comes from my “Blink and you will miss it” foray into the food-service industry.

I worked at a fast-food restaurant, which is even more grueling than working in a trendy bar or a Michelin-starred restaurant.

Oh — and no tips.

Turns out you don’t get a gratuity after waiving “Happy Trails” to a cranky customer who just told you to do something anatomically impossible to yourself. So please, excuse me if I don’t have much empathy for those who say they shouldn’t have to pay taxes on their income.

Tips are income, period. And that income averages $25 an hour for wait staff at full-service restaurants, according to the payroll company ADP. At upscale restaurants, $50 an hour is not uncommon.

The solution for people who aren’t happy with what they’re earning from tips: Get another job.

Maybe teach in a Catholic school, where they don’t get tips and their entire paltry income is taxed. Maybe become a trash collector where the conditions of your employment are likely far worse than a job serving up platters of pasta. Perhaps become a healthcare worker and empty bedpans, with no tips, for minimum wage.

Whatever you do, though, do not try to convince me that your tips should get a subsidy from fellow taxpayers.

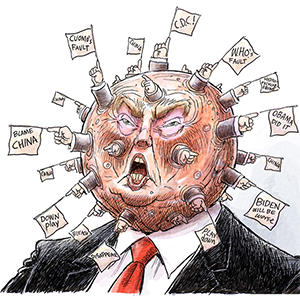

In case you missed it, yes — I am outraged by Congress approving one of President Donald Trump’s most pandering campaign promises. I doubt this put him over the top last November, but I do remember him out on the campaign trail talking like some 21st-century Emma Goldman about the value of the proletariat, and how they needed a break from the establishment.

Giving one group of people a special tax break, whether or not they need or deserve it, is an insult to the other hardworking Americans who show up every day, do their jobs, and rarely get so much as a “thank you,” much less a 20% tip.

I suppose I now have to learn how to cook.

_____

ABOUT THE WRITER

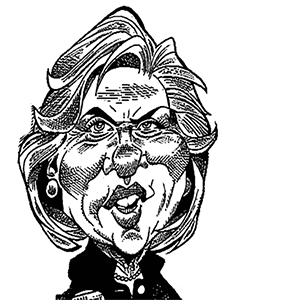

Christine Flowers is an immigration lawyer in Philadelphia. She wrote this for InsideSources.com.

_____

©2025 Tribune Content Agency, LLC

Comments