Editorial: The federal financial cop is off the beat. Fraudsters are lurking, so don't fall prey

Published in Op Eds

When the financial markets go wild, investors naturally want to know, “What’s next?” Unfortunately, one answer turns out to be true every time: Brace yourself for a big upswing in financial fraud.

Market volatility and economic uncertainty combine to make everyone more vulnerable to fraud, from expert traders to regular folks who rarely think about their portfolios except when fear is on the rise.

Last week, the VIX contract measuring fear in the stock market at Cboe Global Markets in Chicago surged to its highest close since the start of the pandemic five years ago. That spells opportunity for criminals seeking to take advantage of a population justifiably worried about its economic future.

At the same time, investment scams have become more sophisticated. Artificial intelligence and other cutting-edge technology make them harder to spot and easier to implement on a large scale. The stakes are higher than ever.

The Federal Trade Commission last month announced that Americans reported $5.7 billion in losses from investment fraud in 2024, up 24% from the prior year. The increase was driven not from an uptick in the number of fraud cases, but rather from crime paying off at a higher rate. Last year, 38% of those reporting fraud said they had been cheated out of their money, up from 27% in 2023 who said the scams they’d experienced had cost them.

Illinois residents evidently are juicy targets, reporting more fraud per capita than residents of 40 other states, according to the FTC. Older adults in Illinois are especially susceptible, with those between 60- and 69-years-old accounting for more losses than any other 10-year age group.

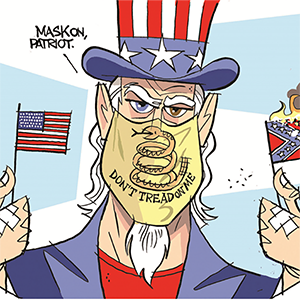

This year could be a lot worse than 2024, not least because Uncle Sam is letting down its guard. From Day One of his second term, President Donald Trump has targeted federal watchdogs responsible for protecting consumers.

Through Elon Musk’s Department of Government Efficiency, the Trump administration has set out to dismantle the Consumer Financial Protection Bureau. While this page supports the goal of cutting red tape and saving tax dollars, every American should be aware that the CFPB, now sidelined, has recovered over $20 billion in financial relief for U.S. consumers since Congress launched it after the 2008 market crash.

DOGE operatives also have pushed for mass firings at the Internal Revenue Service, an agency with a strong consumer-protection mandate that provides a huge return on every dollar the government invests in running it. Slashing its workforce, as the Trump administration has set out to do, makes zero budget sense and encourages criminal behavior.

Similarly, the administration has redirected federal law-enforcement agencies away from prosecuting financial predators to focus on its immigration crackdown and other Trump priorities. The Justice Department recently disclosed that it has disbanded its cryptocurrency fraud unit, for instance, even though scams using crypto as a payment method are on the rise.

Earlier this month, as his tariff fiasco roiled financial markets, President Donald Trump declared, “This is a great time to get rich, richer than ever before.” It would be true to form if criminals were among those most eagerly taking Trump at his word.

Consider gold, an investment that usually does well when stocks and bonds do badly. Gold has always held a special allure for investors who see it as a safe harbor, especially today when incompetence at the top threatens to blow up financial assets. Rest assured that con artists are standing by to exploit gold’s allure.

A recent scam in Wisconsin began when dozens of unsuspecting households were told their bank accounts had been hacked.

Posing as federal agents, the scamsters goaded one older office worker into emptying her accounts of more than $400,000, using the funds to buy gold bars, then handing over the precious metal to a “courier” for supposed safekeeping. The victim alertly wrote down the license plate of the alleged courier, who was swiftly arrested, and has since been ordered to pay restitution.

The case had several elements that watchdogs warn investors to be wary of: The scammers pretended to be from a trusted organization, claimed they were trying to help the victim, pressured her to act immediately and prescribed a specific method of payment, namely gold.

If anyone reaches out unexpectedly, claiming to be a person in authority, saying you must quickly hand over money, don’t do it. Instead, block unwanted calls and messages and refuse to provide financial information in response to an unexpected request. Resist the pressure to turn over funds on the spot via wire transfers, payment apps, gift cards, cryptocurrency or, of course, gold bars.

Perhaps more than ever in its modern history, America is headed toward a government that won’t do much more to help consumers beyond the traditional warning of “Buyer Beware.” So take that warning to heart, and especially in these uncertain times, be on guard for criminals who want to separate you from your hard-earned savings.

_____

©2025 Chicago Tribune. Visit at chicagotribune.com. Distributed by Tribune Content Agency, LLC.

Comments