Justin Fox: No, Elon Musk hasn't 'discovered' fraud at Social Security

Published in Op Eds

Last year, it suddenly fell to me to manage the affairs of a couple of ailing and now deceased elderly people (my parents-in-law). As anyone who has been through this ordeal knows, it involves spending lots and lots of time on the phone and online communicating with banks, insurers, medical billing departments and other service providers.

The experience offers a useful perspective on the efficiency and responsiveness of various institutions. The worst were, big surprise, a cable company and a health-plan administrator. Banks varied in their customer service, with small banks generally more pleasant to deal with than big ones, although I did find it endearing of big bank Capital One that I could always tell my question was about to be answered or problem solved when my call was finally transferred to someone with a Southern accent.

One organization stood out from the rest for its sheer, ruthless efficiency: the Social Security Administration. I called only once, and with a predicted wait time of more than an hour opted for a callback. A representative did and informed me that the thing I wanted to ask her to do (adjust benefits to reflect the death of a spouse) had already been taken care of.

The SSA summarily pulled just-deposited payments out of bank accounts (because the recipient had died), in one case before I even had death certificates in my hands. But it also followed up quickly after the second of those removals, acknowledging that it now owed a little money and asking for details of next of kin to send it to.

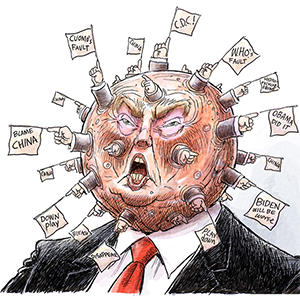

So when newly minted government-efficiency expert Elon Musk hints — without providing any evidence — that there is serious fraud at the Social Security Administration, I must say I’m extremely dubious.

Sure, checks sometimes go out to recipients who shouldn’t receive them, with the SSA estimating that it made $13.6 billion in overpayments in the 2023 fiscal year. But that was out of $1.3 trillion in disbursements. Even if the actual overpayment amount is several times larger, it’s still not much relative to the huge scale of Social Security.

It is true that administering Social Security’s main program, Old-Age and Survivors Insurance, doesn’t involve a lot of judgment calls or customer input. You’re either old enough to qualify for benefits or you’re not, and you’re either alive or you’re not. But its efficiency is still impressive. OASI administrative costs amount to just 0.4% of total spending, down from 1.6% half a century ago. General and administrative expenses at Musk’s Tesla Inc. — not an apples-to-apples comparison, of course, but still interesting to note — are 4.6% of revenue.

Social Security’s smaller Disability Insurance program involves more judgment calls, higher administrative costs and greater potential for fraud and error, and the even smaller Supplemental Insurance program even more so.

But much of the fraud that takes place appears to be of the small change, one-person-at-a-time sort — in contrast to the larger-scale continuing fraud issues at Medicaid and Medicare, and the big pandemic frauds involving unemployment insurance and Paycheck Protection Program loans. And the flip side of cracking down too hard on potential Social Security fraud is that you probably end up denying benefits to many people who have earned them.

The White House Office of Management and Budget keeps track of agency estimates of “improper” and “unknown” payments back to 2004 at its PaymentAccuracy.gov website. The totals added up below aren’t necessarily all fraud, and there may be fraudulent payments that agencies think are legitimate. But clearly, payments to health-care providers offer the biggest fraud opportunities (Medicaid, the health-care program for the poor, ranks No. 1, but that’s only because Medicare, the health-care program for the elderly, is broken up into three parts).

Medicare and Medicaid fraud are well-known problems, the subject of congressional hearings, Government Accountability Office reports and much other scrutiny. They can certainly stand even more scrutiny and, who knows, maybe Musk and his team of coders will turn up something useful. What Musk has said so far about Social Security, though, does not give much confidence.

His statement on X that that he had “just learned that the social security database is not de-duplicated, meaning you can have the same SSN many times over,” was met with widespread derision online from software engineers who said de-duplication doesn’t mean that at all (it apparently refers to a process to free up storage space). And his claim in the Oval Office last week that “we’ve got people in there that are 150 years old” was, while possibly accurate, neither (1) news nor (2) necessarily indicative of a significant problem.

In 2023, Social Security’s inspector general reported that as of 2020 Social Security’s “Numident” file of each person issued a Social Security number contained 18.9 million entries for people born in 1920 or earlier with no death information, while the Census Bureau estimated there were only 86,000 Americans that old. Only 44,000 of these centenarians were actually receiving Social Security benefits, though.

The other records were almost all people who died before the automated reporting system that so rapidly registered my in-laws’ deaths was put in place. The inspector general recommended that the Social Security Administration add presumed death information to the inactive records, but the ever-frugal SSA objected that the benefits of doing so wouldn’t be worth the estimated cost of $5.5 million to $9.7 million.

Government computer systems are full of legacy quirks like this, and upgrading and updating them is a huge and often-fraught endeavor. Social Security also has serious looming funding problems that are the product of its design and the aging of the US population, not its operations. Do Musk and his Department of Government Efficiency have ideas for dealing with either of those issues? So far they’ve given no sign of it.

_____

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

Justin Fox is a Bloomberg Opinion columnist covering business, economics and other topics involving charts. A former editorial director of the Harvard Business Review, he is author of “The Myth of the Rational Market.”

_____

©2025 Bloomberg L.P. Visit bloomberg.com/opinion. Distributed by Tribune Content Agency, LLC.

Comments