New Year’s resolutions for sellers, part one

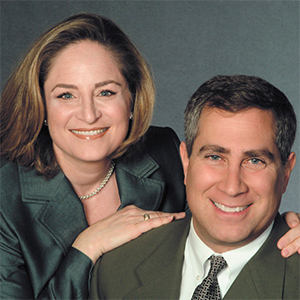

Every year, Ilyce and Sam offer their readers New Year’s resolutions for home buyers, sellers and their personal finances. These are their thoughts on the housing market and their Home Seller Resolutions.

For the past few years, home sellers have had it pretty good. The post-COVID-19 housing market was a seller’s paradise: homes flew off the market in days, buyers waived contingencies, and bidding wars were the norm. Multiple offers? Check. Above asking price? You bet.

But if you’re planning to sell in 2026, it’s time for a reality check. The tide is turning.

Nearly half of all sellers — 42% to be exact — are now cutting their listing prices. Homes are sitting on the market for an average of 70 days, up from the low 60s just months ago. And for the first time in over two years, home prices nationally have gone negative, down 1.4% in the last three months.

Meanwhile, inventory is surging. As of this writing, active listings were up nearly 27% compared to a year ago and on track to hit pre-pandemic inventory levels. Translation: Buyers have options again. And when buyers have options, sellers have to work harder.

Don’t panic, though. Sellers are still making substantial profits — a median of $119,000, representing a 50.2% return on their original purchase price. That’s not too shabby. But those numbers are down from 2024, and the trend is clear: The golden age for sellers is cooling off.

So, what’s a home seller to do? The same thing buyers should do: make smart resolutions and stick to them. Here are our first five resolutions for home sellers:

Home Seller Resolution No. 1: Price it right from day one

Here’s the hardest pill to swallow: Your home is worth what someone is willing to pay for it today — not what your neighbor’s house sold for two years ago.

In today’s market, overpricing is the kiss of death. Homes that sit accumulate “listing stink,” and before you know it, you’ve been on the market for 112 days (the current national average for stale listings). Look at the data: 42% of sellers are already cutting their prices.

Work with your agent to price competitively based on actual closed transactions from the past 90 days. If your agent suggests a lower price than you’d like, listen to them.

Home Seller Resolution No. 2: Accept that concessions are the new normal

Remember when buyers were lucky if you even looked at their offer? Those days are gone.

In the first quarter of 2025, 44.4% of sellers offered concessions — everything from covering closing costs to buying down rates to repair credits. In some markets like Seattle (71%) and Portland (64%), it was even higher.

Buyers are stretched thin with 6% mortgage rates and elevated home prices. Concessions might include paying 2% to 5% toward closing costs, buying down the mortgage rate, offering a home warranty, or providing repair credits. It’s better to offer strategic concessions than have your home sit for months while carrying costs pile up.

Home Seller Resolution No. 3: Make your home shine (but don’t overspend)

With inventory at a five-year high, buyers can afford to be picky. That popcorn ceiling or dated backsplash might turn off buyers comparing your home to three others in the same price range.

Focus on essentials: deep clean everything, fresh paint in neutrals, fix obvious issues (leaky faucets, broken tiles), enhance curb appeal, declutter and depersonalize, and consider professional staging (average cost: about $1,800, but it reduces days on market ).

What you shouldn’t do: Undertake major renovations hoping to recoup every dollar. In a softening market, over-improving can backfire.

Home Seller Resolution No. 4: Be realistic about timing

If you don’t have to sell right now and your local market is softening, consider whether waiting makes sense — or whether you should move quickly before conditions worsen.

The data shows regional variations. Northeast and Midwest inventory is still relatively tight with faster sales. But Sun Belt markets (Florida, Texas, Arizona) are dealing with inventory buildup and price declines. Tampa, Austin, Dallas, and Phoenix have been hit particularly hard.

If you need to sell (job relocation, divorce, family changes), timing isn’t optional. But talk to a trusted local agent. National trends are useful, but your neighborhood’s micro-market conditions matter more.

Home Seller Resolution No. 5: Work with a top-tier agent (and listen to them)

The National Association of Realtors says “91% of home sellers use a real estate agent — matching the highest percentage on record.” This surprises us. While selling in a shifting market is complicated, there is so much demand it’s worth thinking about whether selling by-owner is worth a try.

In 2025, you need an agent who has deep local market knowledge, can price correctly from day one, has a proven track record in challenging conditions, is an expert negotiator, and understands modern marketing (professional photos, virtual tours, strategic pricing).

Make sure you interview at least three agents. Ask about recent sales, average days on market, and what percentage of list price they’re getting. Check online reviews. Once you’ve hired an agent, listen to their advice — they’re reading the market data you’re not seeing.

========

(Ilyce Glink is the author of “100 Questions Every First-Time Home Buyer Should Ask (4th Edition).” She writes the Love, Money + Real Estate Newsletter, available at Glink.Substack.com. Samuel J. Tamkin is a Chicago-based real estate attorney. Contact Ilyce and Sam through her website, ThinkGlink.com.)

©2025 Ilyce R. Glink and Samuel J. Tamkin. Distributed by Tribune Content Agency, LLC.

Comments