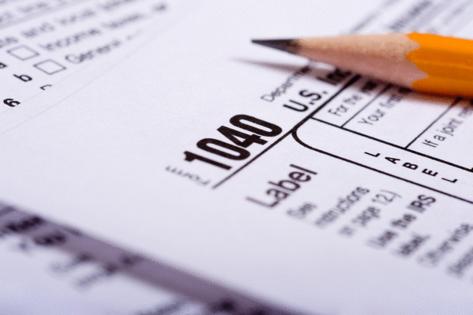

Georgia taxpayers will soon get refunds of up to $500

Published in News & Features

ATLANTA — Georgia taxpayers will see refunds of up to $500 beginning later this spring under a bill signed by Gov. Brian Kemp on Tuesday.

The governor also signed legislation cutting the state income tax rate for this year. The two measures combined will put more than $2 billion back in taxpayers’ wallets over the next 15 months, state officials estimate.

The money could come in handy during a time of rising costs, plummeting stocks and economic uncertainty. Kemp underscored the benefit by signing the measures April 15 — typically the deadline to file federal income tax returns. (The Internal Revenue Service extended that deadline until May 1 for states, including Georgia, affected by Hurricane Helene.)

“Our reason for taking this step is very simple: We know this is your money, not the government’s,” Kemp said, surrounded by legislative and business leaders at the Coca-Cola Roxy concert hall in Cobb County. “And we know you know best how to spend it.”

The governor and legislative leaders have made tax cuts and refunds a priority in recent years as state reserve and “rainy day” funds swelled in a post-pandemic economy. Georgia finished fiscal 2024 with about $16.5 billion in reserves.

House Bill 112 would spend about $1.2 billion of that money on income tax refunds. Individuals or married people filing separately would receive a refund of up to $250. Heads of household would get up to $375, while married couples filing jointly would receive up to $500.

To be eligible for the complete refund, taxpayers must have been full-year Georgia residents in 2023 and 2024 and filed income tax returns for both years. Part-year and nonresidents who filed state returns for both years will be eligible for a partial refund.

You also might receive only a partial refund if you owe money to the state or if you paid less in 2023 taxes than the maximum refund allowed.

Refunds will arrive via direct deposit or by check, depending on the preference filers selected on their returns. The Georgia Department of Revenue will begin issuing the refunds in late May and early June to people who have already filed their tax returns.

Meanwhile, Kemp also signed House Bill 111, which would cut the state’s individual and corporate income tax rate from 5.39% to 5.19% this year. It’s the latest in a series of tax cuts the General Assembly has approved in recent years.

The measure would put an extra $1 billion in taxpayers’ pockets through fiscal year 2026. But individual taxpayers may not notice it much.

An analysis by the liberal-leaning Georgia Budget and Policy Institute found the middle 20% of earners — those making between $45,800 per year and $79,500 a year — would see an average tax cut of $70 per year. The bottom 20% — those making less than $24,400 a year — would see an average cut of $10.

Meanwhile, the top 1% of earners — those making more than $769,300 a year — would see an average tax cut of $2,787 per year.

More information

You can learn more about your eligibility for the Georgia income tax refund at https://dor.georgia.gov/2024-hb-112-surplus-tax-refund-faqs

©2025 The Atlanta Journal-Constitution. Visit at ajc.com. Distributed by Tribune Content Agency, LLC.

Comments