How Zillow changed every step of homebuying and selling in 20 years

Published in Business News

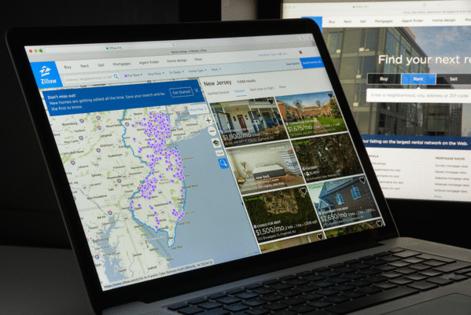

Twenty years ago last week, a Seattle startup called Zillow launched the first public website showing on- and off-market property values.

Since then, and throughout waves of controversy and housing ups and downs, Zillow hasn’t just survived — it’s dominated.

Zillow has ballooned from an advertising business into a market gatekeeper that consumers and real estate agents increasingly rely upon. It has chased growth over profit, aggressively scooping up competitors and expanding its services throughout more than a decade of annual net losses.

And its strategy has paid off.

Last week, just days after its 20th launch anniversary, Zillow executives announced the company had made its first full year of profit since 2012.

Despite a sluggish housing market, the company achieved $23 million in net income in 2025 and 16% revenue growth year over year.

“Our for-sale performance continues to outpace industry transaction trends. … Our long-term strategy here is based on consumer choice and building this integrated end-to-end transaction,” CEO Jeremy Wacksman said in an earnings call last week.

Now with 235 million unique monthly visitors, Zillow has taken advantage of its position as a front door to homebuying by expanding into other services — profiting off each step of the homebuying process.

But its expansion has come at a cost.

Just in the last few years, Zillow has been struck by a torrent of lawsuits accusing the company of antitrust violations, schemes to steer customers toward its services and using its market dominance to squeeze excessive transaction fees from agents.

But so far, the company born into controversy doesn’t seem to be shaken much by the accusations. In fact, Zillow predicts even more revenue in 2026 as it expands its in-house services and leaps headfirst into artificial intelligence.

Zillow declined an interview request for this article.

Zillow launches, crashes and soars

Zillow wouldn’t exist if it weren’t for two former Expedia executives’ frustration with the homebuying process more than two decades ago.

While searching through homes for sale, Rich Barton and Lloyd Frink wanted to know whether the houses were actually worth what their sellers were asking, but they struggled to access that information without a real estate agent.

“It was just mind-boggling that there was no website that did this,” Frink told GeekWire in 2016.

So they came up with the idea for a free platform called “Zillow,” a portmanteau of “zillions” and “pillow,” that would use software to analyze and predict property values.

The startup attracted national media attention. Hundreds of thousands of people turned on thick computer screens on the morning of Feb. 8, 2006, to look up home price estimates on Zillow for the first time.

“Yeah, it immediately crashed,” Barton told NPR’s How I Built This in 2021. “ … I remember being kind of curled up in a ball on … our CTO’s couch, and just kind of rocking back and forth saying, ‘Make the pain stop. Get things back up.’”

After several hours, the website was back up, drawing more than a million users within days.

For many, it was love or hate at first sight.

“Zestimates” initially had a high median error rate that angered many homeowners. But once the general public got a taste of Zillow, there was no going back to the way things were, said Steven Bourassa, director of the Washington Center for Real Estate Research. Zillow had permanently changed the way people thought about buying and selling homes.

“You could just walk around a neighborhood with the (website) open and get a sense of which houses you could buy very easily. In the past, there was nothing like that,” he said.

After surviving the housing crash, Zillow continued to grow, launching its mobile app and adding rental listings. By the time it became a publicly traded company in 2011, Zillow was valued at nearly $540 million.

Zillow managed to rake in an annual profit in 2011 and 2012. But its ambitions were beyond what its advertising income could support — contributing to ongoing annual losses as the company acquired competitors, including Postlets, Rentjuice, Hotpads, StreetEasy, Trulia and Dotloop.

To support its growth, Zillow spent the 2010s transitioning from an advertising business to a homebuying service.

“We will continue to help dreamers search and find their next home,” Barton wrote in a Zillow 2018 annual report. “But now Zillow can also more directly help them buy, sell, rent and borrow, on their terms.”

Diving into transactions

Over the next decade, Zillow fundamentally changed how it made money.

Real estate agents, who had been some of Zillow’s most vocal critics, quickly became its primary customers as the company developed agent tools and lead-generating programs.

Starting in 2012, agents could pay Zillow to appear next to listings in a certain area (even though they didn’t represent the listing). Three years later, the program accounted for almost 70% of Zillow’s revenue.

“This is an important metric that we seek to grow by increasing lead volumes to agents and brokers who convert leads effectively, and by providing them with tools and training to improve their lead conversion,” Zillow’s then-CEO Spencer Rascoff said in a 2015 earnings call.

Starting in 2019, Zillow began shifting toward a model where agents who closed on a deal through a Zillow lead paid up to 40% of their commission to Zillow instead of paying upfront. That meant bigger payouts, even if they were less frequent than a monthly subscription.

Around the same time, Zillow found another way to make money: mortgages.

Following its acquisition of Mortgage Lenders of America in 2018, Zillow launched an in-house financing option called Zillow Home Loans and used affiliated agents to attract customers.

Zillow’s annual mortgage revenue reached $199 million in 2025.

“Ideally, if the buyer and the agent are working together, we have a shot at that mortgage because we're introducing Zillow Home Loans to those agents and trying to earn their business as one of our preferred lenders,” Wacksman told Real Estate News in August. “That's what drives the growth.”

Although Zillow found most of its success from people buying homes, a quest to buy homes itself became its biggest public — and financial — failure.

It launched a program to buy and resell homes in 2018 using its Zestimates as starting points for offers. At the time, so-called iBuying was thought to be a golden opportunity for real estate information companies, with competitors Redfin, Opendoor and Offerpad also diving into the business.

But market volatility during the pandemic made estimating the cost of homes challenging, causing Zillow to pay more for homes than it could resell them for.

Zillow shuttered the program in 2021, laying off a quarter of its staff and posting a nearly $528 million loss for the year.

“You’re not always going to be right,” current CEO Wacksman told Bloomberg last month about the venture. “But if you’re not willing to take a big swing, then you risk missing whatever the next wave is.”

Growing pains

As Zillow’s influence grew, so did its legal challenges. Within the last year, regulators and consumers have slammed the company with numerous antitrust and consumer protection claims.

“Any time you get big, you get sued,” said Douglas Ross, a University of Washington law professor specializing in antitrust litigation. “That effect can be magnified if you’re dealing in an industry like this one.”

The lawsuits that likely drew the most attention came from the Federal Trade Commission and five states last fall, accusing Zillow and its fellow Seattle-based real estate listing giant Redfin of allegedly conspiring to eliminate competition for rental housing listings.

The pair had made a $100 million deal in February 2025 for Zillow to become the exclusive provider of multifamily rental listings on Redfin — an agreement Zillow touted as giving renters access to a larger pool of available apartments.

“In a pretty concentrated market, that could well be considered anticompetitive,” Ross said.

The other high-profile lawsuits came from consumers and agents who accused Zillow of using its monopoly power to charge agents excessive commission fees and steer homebuyers using those agents toward its mortgage services.

Zillow has denied wrongdoing related to these lawsuits and doesn’t seem to be worried about having to change its business practices.

“We are confident in our positions and approach, and we do not expect these matters to have a material impact on our financial position or long-term strategy,” Wacksman said in an earnings call last week.

However, the company told investors its legal expenses would be higher than expected in 2026.

“Legal will be a drag. … But overall, we still expect to expand margins similar to what we've done in 2024 and 2025,” chief financial officer Jeremy Hofmann said.

Zillow’s stock, which had fallen around 44% over the last year, partially in response to a softening housing market, tanked after the earnings call.

But investor analysts still have a positive outlook on the long-term performance of Zillow’s stock, especially as the housing market improves and legal expenses fall.

“Underneath these cases, you have a business that is actually functioning very well right now,” said Nikhil Devnani, a senior analyst at Bernstein covering Zillow. “The structural implications for the business are not necessarily upending.”

The future of Zillow

The barrage of legal challenges hasn’t held Zillow back from its expansion. As Zillow prepares for another quarter of boosted revenue, the company is all in on generative AI.

The real estate transaction process can be filled with busywork that Zillow seeks to offload to technology, Wacksman told Fortune’s Leadership Next podcast in July.

“That is all incredibly ripe for not just an intelligent layer of technology to become proactive and fill in the gaps, but an agentic layer to actually maybe do the work for them to make it more delightful,” he said.

Zillow software now allows for virtual staging and online home tours that capture every angle. In October, Zillow became the first real estate app to integrate directly with OpenAI’s ChatGPT, which allows users to search for homes using especially specific criteria.

Zillow is already piloting AI tools for real estate agents and loan officers that will summarize phone calls, suggest next steps and, eventually, possibly schedule those next steps.

Devnani said he’s excited to see how Zillow can evolve using AI, considering the company has already flourished through the age of the internet and mobile devices.

“What we’ve seen from Zillow is that they’ve managed through different transitions very well,” said Devnani. “I think this is the third big transition they’re going to have to navigate.”

Although Zillow economists predict home sales will remain flat in 2026, they also say the share of median household income spent on a newly purchased home returned to 32% in December, down from its peak of 38% in 2023.

“We think that's a good sign that should drive a broader recovery over time. We're just not necessarily planning for it in 2026,” Hoffman said on the earnings call.

In the meantime, Zillow will focus on improving its rentals business, which is its fastest-growing revenue segment. Zillow’s rental revenue rose 39% year over year, and, in 2026, Zillow expects 30% growth.

With its Redfin deal, Zillow is gaining dominance in the rentals market as it continues to roll out new online tools for renters and landlords.

“The trajectory we're seeing in rentals reinforces why it continues to be one of our most compelling growth opportunities,” Wacksman said on the earnings call.

As Zillow projects even more growth this year, competitors are spending aggressively to catch up to its level of brand awareness, investor analysts pointed out — with Redfin, one of Zillow’s most significant competitors, airing a Super Bowl ad with Lady Gaga.

But Zillow executives aren’t worried about the company losing its dominance. They say the company has 2.5 times Redfin’s and Realtor.com’s monthly visitors, and that “Zillow” continues to be searched more than the term “real estate” on Google.

“As the category leader, with such strong, not just brand awareness, but brand preference, we tend to benefit when others in the category advertise,” Hoffman said on the earnings call.

©2026 The Seattle Times. Visit seattletimes.com. Distributed by Tribune Content Agency, LLC.

Comments