Business

/ArcaMax

Legal fight reopens over Trump's push to tax low-value imports

A U.S. trade court has revived a challenge to President Donald Trump’s move to end a tariff exemption for low-dollar imports, resuming a legal fight with financial stakes for online retailers and small businesses as well as Americans who directly buy goods overseas.

Litigation over what’s known as the de minimis exemption was on hold while ...Read more

Chrysler reveals details and pricing for updated Pacifica minivan

Chrysler's refreshed 2027 Pacifica minivan includes updated front-end styling, new safety features and other tweaks for a base price of about $45,000, the brand said Monday.

Chrysler said orders for the seven or eight-passenger van are open this week and it is scheduled to arrive in dealerships this summer.

The Pacifica was introduced for the ...Read more

Expect plane tickets to get spendier as war in the Middle East pushes up jet fuel costs

Airfare prices are likely increasing, and soon, as the cost of jet fuel has risen dramatically since the start of the war in Iran on Feb. 28.

Travelers may see fuel prices impacting airfares “quickly,” United Airlines CEO Scott Kirby said at an event in Boston last week, according to CNBC.

Airlines “will adjust their future ticket prices...Read more

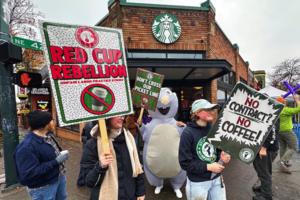

Starbucks will shutter five Seattle stores

Starbucks plans to shutter five coffeehouses, including four unionized stores, in Seattle next month.

The affected stores are located on First Hill, in the University District, in the Seattle Center Armory, in Seattle Children’s hospital and in the Metropolitan Park East building downtown.

Except for the Met Park East tower location, workers...Read more

Anthropic sues US government over supply chain risk label

Anthropic PBC sued the Defense Department for declaring that the artificial intelligence giant posed a risk to the U.S. supply chain, further ramping up a high-stakes dispute with the Pentagon over safeguards on the company’s technology.

San Francisco-based Anthropic is challenging a decision by the department and other federal agencies to ...Read more

Apple postpones smart home display launch as it waits for new AI and Siri

Apple Inc.’s artificial intelligence struggles are rippling through its product plans, forcing the company to delay a long-in-the-works smart home display until later this year, according to people with knowledge of the matter.

The product, code-named J490, was first scheduled for spring 2025 but was postponed to let the company finish work ...Read more

Netflix goes from M&A loser to market winner without Warner deal

Netflix Inc.’s stock price is staging a dramatic reversal triggered by management’s decision to walk away from its proposed acquisition of Warner Bros. Discovery Inc. late last month.

“The core business is phenomenal and they never needed that deal — it was a nice to have, not a must have,” Wedbush analyst Alicia Reese said. “It’...Read more

JBS workers in Colorado to go on strike next week, union announces

Thousands of workers at the JBS meatpacking plant in Greeley, Colorado, plan to go on strike March 16 amid stalled contract negotiations and accusations that the company is committing unfair labor practices.

United Food & Commercial Workers Local 7, the union representing 3,800 JBS laborers, announced Monday that its bargaining committee has ...Read more

Survey: Americans are increasingly entangled in financial scams; experts say AI is contributing to the problem

A growing number of people say they’ve experienced some form of financial fraud over the past year, especially older, white Americans, despite taking a variety of precautions to protect themselves, Bankrate’s latest national survey has found.

Experts said scammers are getting increasingly crafty, using artificial intelligence to clone ...Read more

Here's why Ford, GM are approaching autonomous vehicles differently

Detroit automakers say increasingly autonomous and software-defined vehicles will arrive in showrooms in the next couple of years, but how they're achieving that status and rolling out the technology follows two different approaches.

Both Ford Motor Co. and General Motors Co. have pegged 2028 for the launch of Level 3 automated driving systems,...Read more

From startup seedling to cannabis powerhouse, Verano has navigated the industry's ups and downs

When Illinois took the plunge and legalized medical marijuana in 2013, restaurateur George Archos decided he would get in on the ground floor.

Archos, who grew up in the family restaurant business, had already opened several successful Wildberry Pancake and Cafe locations in Chicago and the suburbs, and was convinced his hospitality experience ...Read more

Live Nation reaches tentative settlement with Justice Department in antitrust lawsuit

Live Nation has reached a settlement with the Justice Department in an antitrust case that put the entertainment giant at risk of being separated from Ticketmaster.

Less than a week after the long-awaited trial began, the ticket vendor's settlement offer was announced, per a court hearing on Monday. With pending approval from the judge, Live ...Read more

Lawsuit alleges Google chatbot was behind a user's delusions and death

Google's artificial intelligence chatbot Gemini encouraged a 36-year-old Florida man to embark on violent missions and to take his own life, a lawsuit alleges.

The man, Jonathan Gavalas, started using the chatbot in August 2025 to help write, plan travel and assist with shopping. But after he activated Google's most intelligent AI model, Gemini...Read more

As gas prices rise, California gets punched harder at the pump than other states

Californians are feeling more pain at the pump than any other state as the conflict with Iran pushes up prices.

Spencer Shearer was filling up his Nissan Sentra on Friday morning at the Chevron station in Brentwood near San Vicente and Montana avenues and paying a rate higher than almost anywhere else in the country: $5.55 per gallon.

"It ...Read more

Judge sends former Google chief's spying, sexual assault lawsuit to arbitration

A lawsuit filed by a former girlfriend and business partner of tech billionaire Eric Schmidt accusing him of sexual assault was sent to arbitration this week by a Los Angeles judge.

Michelle Ritter, 32, of Los Angeles, alleged that a 2022 federal law inspired by the #MeToo movement intended to end forced arbitration of sexual assault and ...Read more

Labubu maker Pop Mart is opening US headquarters in Culver City

Pop Mart, the Chinese toymaker known for its collectible Labubu dolls, reportedly plans to open a new office building in Culver City as it seeks to expand its North American presence.

The 22,000-square-foot office will serve as Pop Mart's new U.S. headquarters, according to real estate data provider CoStar, which earlier reported the deal.

Pop...Read more

Mercedes-Benz settles case over alleged union-busting in Alabama

Mercedes-Benz Group AG vowed not to make anti-union threats as part of a deal to resolve a U.S. labor board case over the company’s response to a high-stakes Alabama organizing drive.Under a settlement with the National Labor Relations Board, the automaker said it will distribute, and adhere to, a notice about employees’ union organizing ...Read more

Michigan regulators tell marijuana shops to stop using dispensary label

LANSING, Michigan — The state's marijuana regulator is instructing marijuana retail shops and provisioning centers to stop referring to themselves as dispensaries, stressing that the term, legally, is reserved for pharmacies.

The reminder issued to licensed cannabis retailers on Wednesday was first issued in a 2019 bulletin, but was repeated ...Read more

Terry Savage: Social Security Fairness Act windfalls can surprise some seniors with higher property tax bill

Seniors who received a windfall deposit as a result of the Social Security Fairness Act are now finding that the consequences of that unexpected benefit can be costly, especially in Illinois.

As a reminder, early last year seniors who had been receiving reduced Social Security benefits because they also had public pension benefits suddenly ...Read more

Shock drop in US payrolls casts doubt on steadying job market

U.S. employers unexpectedly cut jobs in February and the unemployment rate rose, pointing to lingering fragility in a labor market that was thought to be stabilizing.

Nonfarm payrolls fell 92,000 last month, one of the largest declines since the pandemic, after a strong start to the year. While some of the downside was expected in advance, like...Read more

Popular Stories

- Auto review: 2026 Mazda CX-5 gains a great new screen but loses something in the process

- Here's why Ford, GM are approaching autonomous vehicles differently

- From startup seedling to cannabis powerhouse, Verano has navigated the industry's ups and downs

- Live Nation reaches tentative settlement with Justice Department in antitrust lawsuit

- Apple postpones smart home display launch as it waits for new AI and Siri